Navigate the real estate world with confidence and insider tips!

Time in the Market Beats Trying To Time the Market

Some Highlights

- Are you torn between whether to buy a home now or wait? Consider this.

- Forecasts show prices will climb for at least the next 5 years. If you wait, the price of a home will be higher later on. But, if you buy a $400K now, you could gain roughly $83K in equity as prices rise.

- If you're able to buy now, this equity is one reason why it'll be worth it in the long run. Connect with an agent if you're ready to talk through ways we can make it happen.

The Secret To Selling? Using an Agent To Get Your House Noticed

In a recent survey, the National Association of Realtors (NAR) asked sellers what they want most from a real estate agent. The number one answer was to help market their house.

It makes sense. The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers. That’s why it’s so important to work with an expert local agent that knows what they're doing.

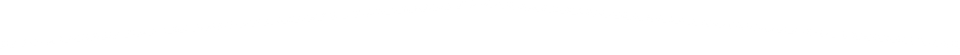

According to that same report from NAR, here are some of the most common methods real estate agents use to market homes, and how you benefit when your agent uses them effectively (see graph below):

- Listing on the MLS – Real estate agents have access to the Multiple Listing Service (MLS) database. And that’s great for you because having your house on the MLS helps it get more visibility from other agents and buyers. And the more people who see it, the more likely it is to sell.

- Using a Yard Sign – A yard sign may seem simple, but it’s one of the best ways to catch the attention of people driving or walking by. And when it does, they’ll help spread the word to friends and family who are looking to buy that there’s a house for sale in the area. It also puts your agent’s contact information on display, making it easy for interested buyers to get in touch.

- Having an Open House – An open house is a great way to create a sense of competition and urgency among buyers – and that can lead to stronger offers. And since you’ll only need to leave once for many buyers to visit, it makes the process easier for you, too. Plus, an open house helps your agent get real-time feedback about what buyers love and what they're not as sold on.

- Showcasing on Your Agent’s Website – Having your house on your agent’s website presents it in a professional way to buyers. And odds are, people visiting your agent’s website are serious and ready to make a move, so this is a smart way to get in front of motivated buyers.

- Social Networking – Posting your house on social helps get your house in front of buyers who may not have seen it with traditional marketing. It also makes it easy for people to share your listing with friends and loved ones.

- Providing Virtual Tours – For buyers who are relocating from out of town, virtual tours allow them to check out your house anytime from wherever they are. This helps reach more potential buyers who may not be able to come to see your house in person.

- Using Video – Video is an excellent way for your agent to show off some of the top features of your house like your kitchen, large closets, outdoor entertainment areas, and other key details that could attract buyers.

- Sending Emails – Sending out information about your house to your agent’s expansive database is another way they’ll get it in front of even more people. Great agents may even send emails teasing that your house is coming to the market as a way to boost interest and excitement before it officially has an open house.

Here’s what it comes down to. Most good agents will write a description of your house for the listing and pair it with high-quality photos. But a great agent will do so much more than that.

They’ll not only lean on their expertise, they’ll put in the time and effort to make sure your house makes an impression on buyers, and ultimately, sells.

Bottom Line

As a seller, working with a creative local real estate agent is a smart way to ensure your house grabs the attention of the right buyers. If you’re ready to sell and want to talk about strategies we can use to get your house sold, reach out to an agent.

Two Resources That Can Help You Buy a Home Right Now

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen.

There are options that can help make buying a home possible today — even if your savings are limited or your credit isn’t perfect. Let’s explore just two of the solutions that could help get you into your first home no matter the market.

1. FHA Loans

If your down payment savings and your credit score aren’t where you want them to be, an FHA loan could be your pathway to buying a home. According to the U.S. Department of Housing and Urban Development (HUD) and Bankrate, the big perks of an FHA home loan are:

- Lower Down Payments: They typically require a smaller down payment than conventional loans, sometimes as low as 3.5% of the home’s purchase price.

- Lower Credit Score Requirements: They’re designed to help buyers with credit scores that might not qualify for conventional financing. This means, when conventional loans aren’t an option, you may still be able to get an FHA loan.

The first step is to connect with a lender who can help you explore your options and determine if you qualify.

2. Homeownership Assistance Programs

And if you need a more budget-friendly down payment, that’s not your only option. Did you know there are over 2,000 homeownership assistance programs available across the U.S. according to Down Payment Resource? And more than 75% of these programs are designed to help buyers with their down payment. Here’s a bit more information about why these could be such powerful tools for you:

- Financial Support: The average benefit for buyers who qualify for down payment assistance is $17,000. And that’s not a small number.

- Stackable Benefits: To make it even better, in some cases, you may be able to qualify for multiple programs at once, giving your down payment an even bigger boost.

Rob Chrane, CEO of Down Payment Resource confirms a little-known fact:

“Some of these programs can be layered. And so, in other words, you may not be limited to just one program.”

If you want to learn more or see what you qualify for, be sure to lean on the pros. A trusted real estate agent and a lender can guide you through the process, explain the help that’s out there, and connect you with resources to make buying a home a reality.

Bottom Line

If you’re ready to stop wondering if buying a home is possible and start exploring solutions, connect with an expert agent and trusted lender.

How Home Equity Can Help Fuel Your Retirement

If retirement is on the horizon, now’s the time to start thinking about your next chapter. And you probably want to make sure you’re set up to feel comfortable financially to live the life you want in retirement.

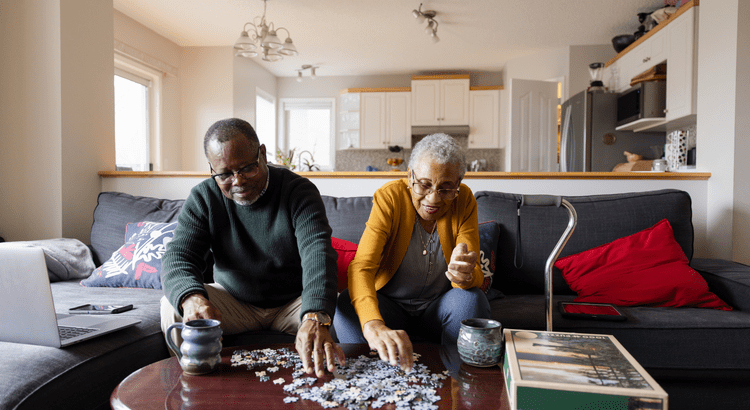

What you may not realize is you likely have a hidden goldmine of cash you’re not thinking about — and that’s your home. Data from the Federal Housing Finance Agency (FHFA) shows that home values have gone up nearly 60% over the last 5 years alone (see graph below):

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

“ . . . Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

So if you’ve been in your house ever longer than that, chances are you have even more equity in your home. If you want to have access to more of the wealth you’ve built up throughout the years, it’s worth thinking about selling your house to downsize.

Why Downsizing Might Be the Right Move

Selling now so you can downsize into a smaller home, or maybe one in a more affordable area, could free up your home equity so you can use a portion of it to help you feel confident retiring. Whether you want to travel, spend more time with family, or just feel financially secure, accessing the equity in your home can make a huge difference. As Chase says:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here are just a few of the ways a smaller home can fuel your retirement:

1. Cut Your Cost of Living

Data from the AARP shows the number one reason adults 50 and older move is to reduce their cost of living. Downsizing to a smaller house or relocating to a more affordable area can help you lower your monthly expenses — like utilities, property taxes, and maintenance costs.

2. Simplify Your Life

A smaller home often means less upkeep and fewer responsibilities. That can free up your time and energy to focus on the things that matter most in your retirement.

3. Boost Your Financial Flexibility

Selling your current house gives you access to your equity, turning it into cash you can use however you like. Whether it’s investing, paying off debt, or creating a financial cushion, it can open up new opportunities for your future.

The First Step Toward Your Next Chapter

If you think you may be interested in downsizing, working with a real estate agent is your next step. Your agent will help you understand how much equity to have and how you can use it. But they’ll do more than that. They’ll also help you navigate the entire process of selling your current home and finding a new one, so you can transition smoothly into a new home and a new phase of life.

Bottom Line

If you’re planning to retire in 2025, now may be the perfect time to downsize and unlock the equity you’ve built up in your home. Connect with a local agent to start planning your move now, so you’re set up to make every day feel like a Saturday.